- Python Financial Libraries and code samples

- EODHD APIs Python Financial Library by Michael Whittle

- Python Financial APIs SDK by Lautaro Parada

- Python Stock API Example

- Exploring Finance APIs

- APIs to Obtain and Analyse Stock Data

- General rules for API selection

- A Step-by-Step Guide on Youtube

- Yahoo Finance API

- FYERS API V2:

- Fetch Full Market Quotes Utilizing Fyers API V2:

Python Financial Libraries and code samples

EODHD APIs Python Financial Library by Michael Whittle

We recomend to start by creating a Python virtual environment to install the Official EODHD APIs Python Library, alternatively, you can install it by using PIP: “python3 -m pip install eodhd -U” or “pip install eodhd -U”. The “-U” will upgrade the library if it is installed already but out of date.

eodhd-medium % python3 -m venv venv eodhd-medium % source venv/bin/activate (venv) eodhd-medium % python3 -m pip install eodhd -U Collecting eodhd Downloading eodhd-1.0.7-py3-none-any.whl (7.9 kB) Requirement already satisfied: rich==12.5.1 in ./venv/lib/python3.9/site-packages (from eodhd) (12.5.1) Requirement already satisfied: numpy==1.21.6 in ./venv/lib/python3.9/site-packages (from eodhd) (1.21.6) Requirement already satisfied: pandas==1.3.5 in ./venv/lib/python3.9/site-packages (from eodhd) (1.3.5) Requirement already satisfied: websockets==10.3 in ./venv/lib/python3.9/site-packages (from eodhd) (10.3) Requirement already satisfied: websocket-client==1.3.3 in ./venv/lib/python3.9/site-packages (from eodhd) (1.3.3) Requirement already satisfied: requests==2.28.1 in ./venv/lib/python3.9/site-packages (from eodhd) (2.28.1) Requirement already satisfied: pytz>=2017.3 in ./venv/lib/python3.9/site-packages (from pandas==1.3.5->eodhd) (2022.2.1) Requirement already satisfied: python-dateutil>=2.7.3 in ./venv/lib/python3.9/site-packages (from pandas==1.3.5->eodhd) (2.8.2) Requirement already satisfied: urllib3=1.21.1 in ./venv/lib/python3.9/site-packages (from requests==2.28.1->eodhd) (1.26.11) Requirement already satisfied: charset-normalizer=2 in ./venv/lib/python3.9/site-packages (from requests==2.28.1->eodhd) (2.1.1) Requirement already satisfied: certifi>=2017.4.17 in ./venv/lib/python3.9/site-packages (from requests==2.28.1->eodhd) (2022.6.15) Requirement already satisfied: idna=2.5 in ./venv/lib/python3.9/site-packages (from requests==2.28.1->eodhd) (3.3) Requirement already satisfied: pygments=2.6.0 in ./venv/lib/python3.9/site-packages (from rich==12.5.1->eodhd) (2.13.0) Requirement already satisfied: commonmark=0.9.0 in ./venv/lib/python3.9/site-packages (from rich==12.5.1->eodhd) (0.9.1) Requirement already satisfied: six>=1.5 in ./venv/lib/python3.9/site-packages (from python-dateutil>=2.7.3->pandas==1.3.5->eodhd) (1.16.0) Installing collected packages: eodhd Successfully installed eodhd-1.0.71. Use “DEMO” API key to test our data from a limited set of the tickers without registering:

AAPL.US | TSLA.US | VTI.US | AMZN.US | BTC-USD | EUR-USD

Real-Time Data and All of the APIs (except Bulk) are included without limitations on API calls.

2. Register to get your free API key (limitated by 20 API calls per day) with access to:

End-Of-Day Historical Data with only past year for any ticker and List of tickers per Exchange

3. To unlock your API key we recommend to choose subscription which covers your needs

To get started, you’ll need to import “APIClient” for the Library.

from eodhd import APIClientNext is loading the Library.

The code above will require you to pass your API key directly into the APIClient class.

There are nicer ways do this like retrieving the API key from an environment variable.

import os api_key = os.environ.get("EODHD_API_KEY") api = APIClient(api_key)Or retrieving the API key from a config file.

# config.py API_KEY = "YOUR_API_KEY" # main.py import config as cfg api = APIClient(cfg.API_KEY)The Library is ready for work now. Next we recommend is to follow into our Academy section where you’ll be able to learn more of how to use it from article “Download EOD, Intraday and Real-time prices for any Cryptocurrency with Python simply” by Michael Whittle.

Python Financial APIs SDK by Lautaro Parada

The Python Financial APis SDK is a library is the Python SDK provided by our clients for our REST API. It’s intended to be used for data extraction for financial valuations, macroeconomic analyses, sentiment analysis, option strategies, technical analysis, development of machine learning models, and more!

You can also use our comprehensive video instruction on How to Use Python Financial APIs SDK.

The library requires Python 3.8+ and can be found and downloaded on GitHub: https://github.com/LautaroParada/eod-data.

APIs are covered with the SDK:

- Historical Prices, Splits and Dividends Data APIs.

- Historical Splits, Dividends and Short Interest API.

- Techinical Indicator API.

- Intraday Historical API.

- Options Data API.

- Fundametnal and Economic Data APIs.

- Insider Transaction API.

- Fundamental Data: Stocks, ETFs, Mutual Funds, Indices.

- Calendar. Upcoming Earnings, Trends, IPOs and Splits.

- Macroeconomics Data and Macro Indicators API.

- Bulk API for EOD, Splits and Dividends.

- Exchanges API with list of tickers and extended data, trading hours and Market Holidays.

- Stock Market Screener API.

- Search API for Stocks, ETFs, Mufual Funds and Indices.

More information with examples and a comprehensive readme file you can find on the Github page for the Python Financial APis SDK.

And we also have very simple python stock API examples for a quick start below on that page.

Python Stock API Example

It’s easy to download our JSON API with Python scripts, please do not forget to change the API token to yours, which you can get on the settings page after the free registration.

import urllib, json url = "https://eodhistoricaldata.com/api/eod/AAPL.US?api_token=YOUR_API_TOKEN&order=d&fmt=json" response = urllib.urlopen(url) data = json.loads(response.read()) print dataThere is also a simple Python example that was written for us by Femto Trader, for more information you can find on GitHub, check python-eodhistoricaldata.

import requests import pandas as pd from io import StringIO def get_eod_data(symbol="AAPL.US", api_token="xxxx", session=None): if session is None: session = requests.Session() url = 'https://eodhistoricaldata.com/api/eod/%s' % symbol params = r = session.get(url, params=params) if r.status_code == requests.codes.ok: df = pd.read_csv(StringIO(r.text), skipfooter=0, parse_dates=[0], index_col=0, engine='python') return df else:raise Exception(r.status_code, r.reason, url)You can download data simply using

And if you want to avoid too much data consumption, you can use a cache mechanism

Great thanks to Femto Trader (Github) and don’t forget about the full python example python-eodhistoricaldata.

Exploring Finance APIs

This second part in the series covers several well-known finance APIs that you can use in your Python code to obtain and analyse stock data. In particular, we’ll focus on those APIs that are available for free or mostly for free, meaning your requests to the key services and most of the data provided by an API can be done for free.

This part assumes that you’ve already installed a Python environment on your local machine and have familiarised yourself with Google Colab, as discussed in the part 1 of this series. I’ll encourage you to use Google Colab to try the examples in this article.

In this chapter we’ve tried to query the Yahoo Finance library to obtain a stock’s daily trading info and some financial indicators of a company, used Pandas Datareader to get the S&P500’s daily prices, Quandl for the prices of Gold, and Get_all_tickers (or direct CSV files links) for the list of a traded stocks.

APIs to Obtain and Analyse Stock Data

Actually, you have several options when it comes to getting stock data programmatically. The most natural way to obtain stock data is via an API. The data can be received from an API either through an HTTP request (requests library), or a python-wrapper library for the API. In this article, you’ll look at the following APIs:

In this part, we won’t go too deep into financial analysis tasks you can perform with these APIs but rather will look at their general capabilities. However, you’ll get a chance to get your hands dirty with the APIs.

General rules for API selection

It is quite rare when one datasource has enough data to cover all your needs. Thus, Yahoo finance API can provide only daily data, and not hourly and minutes cut.

Many data sources have free tier to try their data (with a limited amount of calls per day), while paid options can have more granularity and no limits on usage.

You need to check when was the last release and how often the datasource is updated. Many Python libraries have their pages on pypi.org, where you can find the stats on the number of installs (more is better), GitHub stars and forks (more is better), current health status. For small projects, you should assume that the datasource can be unreachable sometimes, can return null value or error at any moment.

It can be very handy to see all the API calls details covered in one place. For example, Quandl library has a separate web page for many of its time series with a profound description and code snippets for different programming languages as this one https://www.quandl.com/data/LBMA/GOLD-Gold-Price-London-Fixing

A Step-by-Step Guide on Youtube

Yahoo Finance API

I will summarise its main principles here:

As mentioned in the previous section, it is very useful to look at the PyPi website page of the library (https://pypi.org/project/yfinance/), which can tell you that the project is quite popular mid-July 2020: it has 165k installs per month, 2300 stars on GitHub, 6700 followers on Twitter, last version was released only half-year ago in December 2019.

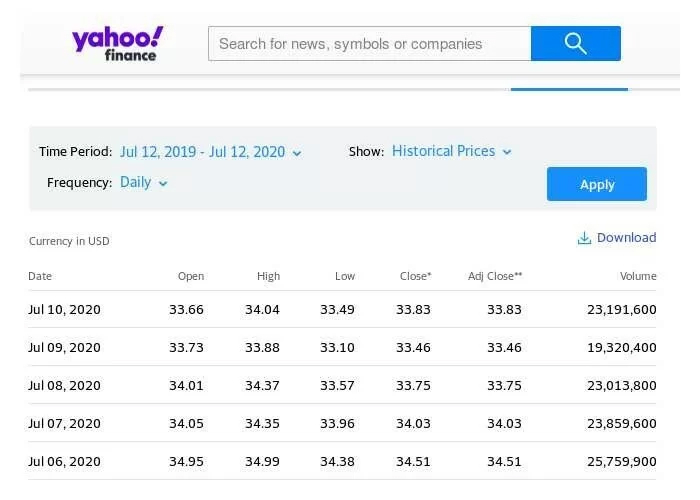

Yahoo Finance API allows you to make 2000 requests per IP per hour => 48k requests per day. Before starting to obtain stock data programmatically with Yahoo Finance API, let’s look at the Yahoo Finance website in a browser to explicitly see what can be found there. Suppose you want to look at historical stock prices for Pfizer Inc.(PFE). To accomplish this, point your browser to https://finance.yahoo.com/quote/PFE/history?p=PFE

The key fragment of what you’ll see in your browser is shown in the following screenshot:

Let’s now try to get some stock data programmatically from Yahoo Finance. To start with, go to Google Colab as it was described in the previous part 1, and open a new notebook to be used for the examples in this article.

To start with, install the yfinance library in your notebook:

FYERS API V2:

After the app is created you will get an App id and Secret id copy them and store them in a text file and required folder for later access now if you check with api docs there is a list of codes in generation of access token in which we can skip few steps in which we need a url which gives a auth_code from web browser for that reason please follow the url as such ‘https://api.fyers.in/api/v2/generate-authcode?client_id=App_id&redirect_uri=https://myapi.fyers.in/docs/&response_type=code&state=None’ now the client id will be yours app id which you received after creation of app and redirect url as of your choice or you can use the redirect url of fyers docs as well.

Now put the auth code you received from web browser in python code and generate the access token and saved them in required text file and folder for later access.If you face any error regarding api access it might be issue due to older installation so please completely wipe them by utilizing pip uninstall in cmd and then go directly installation with pip install fyers-apiv2 and follow the below code as follows.

from fyers_api import fyersModel from fyers_api import accessToken client_id='your_app_id' secret_key='your_secret_id' redirect_uri='https://myapi.fyers.in/docs/' session=accessToken.SessionModel(client_id=client_id, secret_key=secret_key,redirect_uri=redirect_uri, response_type='code',grant_type='authorization_code') auth_code='you received from web browser' session.set_token(auth_code) response = session.generate_token() access_token = response["access_token"] print(access_token) After generation of access token things will get simpler just add the token and client id in required field and call the model and utilize them for placing orders and accessing the details of postions,trades and data as well for writing strategies and implementing strategy as follows.

from fyers_api import fyersModel client_id='your_app_id' token='your_token' fyers = fyersModel.FyersModel(client_id=client_id, token=token,log_path='C:/Users/. /Desktop/current_directory') print(fyers.funds()) Fetch Full Market Quotes Utilizing Fyers API V2:

from fyers_api import fyersModel client_id=open('app_id.txt','r').read() token=open('access_token.txt','r').read().strip() fyers=fyersModel.FyersModel(client_id=client_id,token=token,log_path='C:/Users/. /Desktop/current_directory') symbol= last_price=fyers.quotes(symbol)['d'][0]['v']['lp'] print(last_price)